Brandon Bell

Company overview

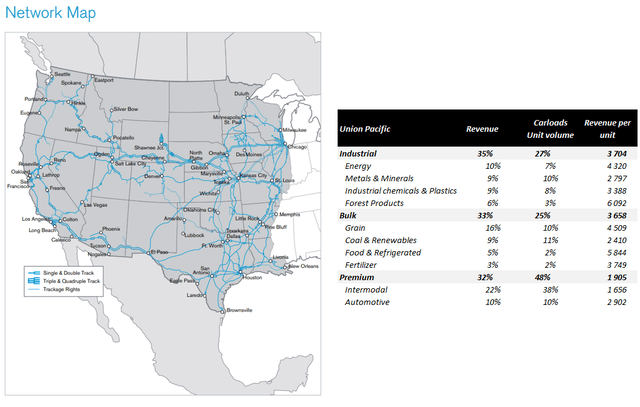

Founded in 1862, Union Pacific (NYSE:UNP) operates one of the largest US rail networks. It has >32.500 route miles, spanning 23 states in the western part of the US, and carries nearly 27% of total rail freight and roughly 11 percent of all long-distance freight volume. The company holds a 26% stake in Ferromex, a Mexican railroad. Railroads own the rail tracks (including the land on both side of the track) and operates their rail networks, locomotives, and rail cars. While some passenger railroads such as Amtrak may use their networks, US railroads deal only with freight transport. Freight revenue account for 93% of total revenue and can be roughly split as one-third between industrial, bulk, and premium categories (see below for a more detailed breakdown).

(Source: Investor Factbook and 2022 annual report)

Industry overview

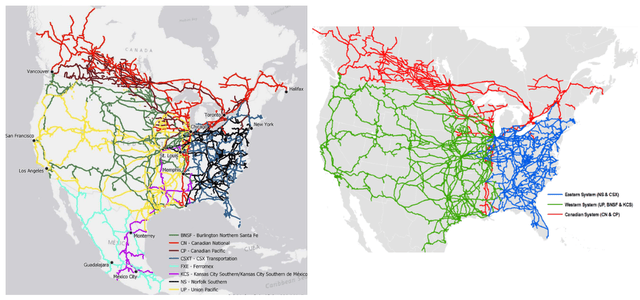

Prior to the Staggers Rail Act of 1980, regulation prevented railroads from adjusting pricing and restructuring their networks (including abandoning duplicative and less dense lines). As a result, the freight rail industry lost market share, was unprofitable and did not have enough money to invest in rail infrastructures, further degrading service quality. The Staggers Rail Act gave railroads a greater freedom for pricing and for entering/exiting markets, which enabled them to regain some market share, restore profitability, restart investments, improve service quality while reducing freight rail fares (prices were halved over a ten-year period). This regulation also led to sector consolidation. Back in 1980, there were 26 Class 1 railroads in North America. Following the implementation of the new regulation, the composition of the freight rail industry declined to 7 class 1 operators by 2001. Following the acquisition of KSU by Canadian Pacific, there are nowadays only 6 class 1 railroads and they operate in regional duopoly. Canadian National Railway (CNR) and Canadian Pacific (CP) cover the Canada from coast to coast and down through the Midwest to the Gulf of Mexico, CSX (CSX) and Norfolk Southern (NSC) operate east of the Mississippi River while Union Pacific and Burlington Northern Santa Fe (owned by Berkshire Hathaway) operate on the western part of the river.

Despite being less flexible and with longer delivery times, rails are the preferred and cheapest option for moving heavy, bulky, low-value goods such as grains, commodities…, especially over long lengths of haul. According to a study of the Congressional Budget Office, moving cargo through rail is 60/70% cheaper than using trucks. This cheaper price is possible because rail transportation is roughly four times more fuel-efficient than trucks and has a larger freight capacity. Indeed, a train with one or two drivers can handle hundreds of containers while a truck needs one driver for one or two containers.

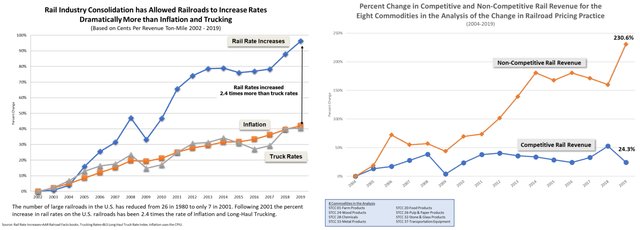

Railroads enjoy pricing power as highlighted by the increase in rates. They increased by more than twice as fast as inflation and trucking rates. In real terms (inflation-adjusted), rates have increased by 43% over the period 2004/2019, which is equivalent to a 2.4% CAGR increase in rate.

(Source: Escalation Consultants)

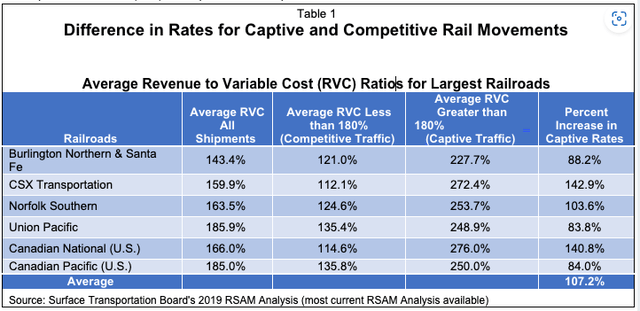

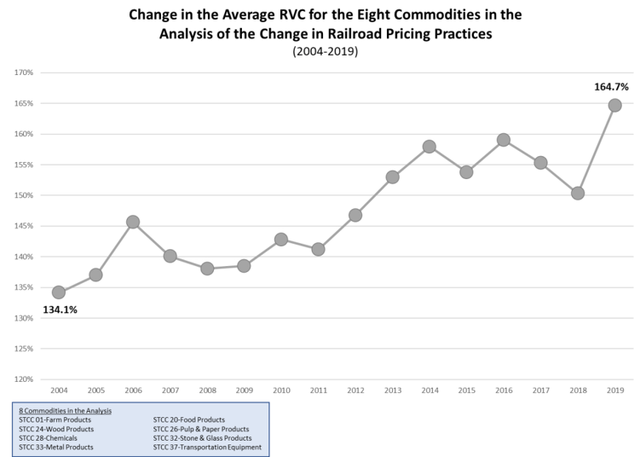

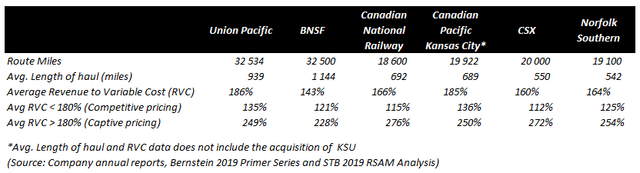

Railroads can raise prices because they deal with captive customers. Indeed, many goods that move by rails (heavy, bulky commodities…) cannot be economically moved with other modes of transportation. Besides, many shippers have no other options because of their locations. For instance, over 70% of locations are served by only one railroad. Following years of increasing rates above cost inflation, the average revenue-to-variable-cost (RVC) ratio increased and reached an average of 167.3% for the industry. This ratio in an important indicator for freight rail rates because a rate above 180% is considered potentially non-competitive by the STB and can be subject to potential reviews. Given the already high level of 167% for the industry, future price increases can be more challenging to pass on (especially given current criticisms regarding service quality) and regulatory scrutiny could increase going forward.

(Source: Railcostcontrol.com and STB)

(Source: Escalation Consultants)

Barriers to entry

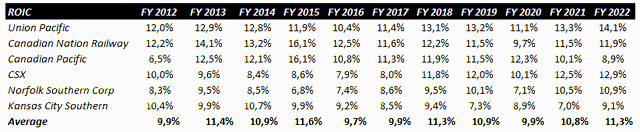

Railroads have one of the longest durability profiles and face low disruption risks. They have been around since the 1800s and should continue to exist for many decades to come. Indeed, they are essential to the US economy as they move >40% of all US freight. Building additional tracks is almost impossible as acquiring the lands and obtaining the regulatory authorizations are hurdles impossible to overcome. Moreover, building new tracks would cost billions of dollars while providing uncertain economic returns given the industry operates at an efficient scale. Indeed, the return on invested capital is around 10%, which enables railroads to be economically viable while not being able to accommodate a new player. Adding one player in the local duopolies could lead to a significant deterioration in profitability, resulting in all players being uneconomically viable.

(Source: Annual reports & Author)

UNP has a competitively-advantaged rail network

UNP's rail network is considered as one of the best in the industry as it benefits from structural advantages. Firstly, it has one of the largest rail networks, spanning two-third of the US (like BNSF) while serving attractive regions such as the west coast and the gulf coast and providing the best access to Mexico. It has a strong foothold among industrial industries (Gulf coast) and critical US infrastructures (Western ports) and longer lengths of haul, which provide UNP an edge over trucks. As a result, UNP has the highest RVC ratio, highlighting its dominant position and stronger pricing power. Finally, unlike eastern railroads, UNP's network structure is simple (lanes are not intertwined…), enabling to run operations more efficiently.

(Source: Google image)

(Source: Company annual reports, Bernstein 2019 Primer Series and STB 2019 RSAM Analysis)

Years of poor operating performance

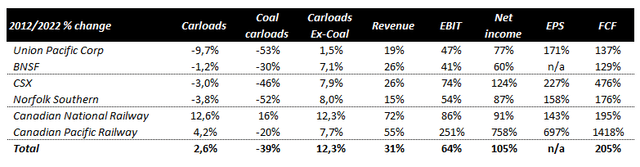

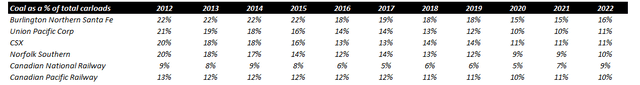

Over the last ten years, Union Pacific significantly underperformed its peers in terms of volume growth. While the number of carloads is 10% below what it was a decade ago, this decline can mainly be explained by the structural decline of coal demand. Indeed, the US shuttered plenty of coal fire generation plants because utilities have shifted to natural gas-sourced electricity production given natural gas became abundant and cheap following US shale revolution.

(Source: Company annual reports & author)

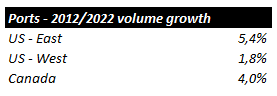

Despite declining volume growth, revenue and operating income grew by 19% (1.7% CAGR) and 47% (3.9% CAGR), respectively, driven by pricing and productivity (EBIT margin increased from 32% to 40%). Canadian peers stand out with much stronger revenue growth because they benefit from the increasing attractiveness of British Columbia ports that are gaining market share over US western ports.

(Source: Bloomberg & Author)

Among US peers, Union Pacific faced the worst volume decline as its coal business suffered more than peers and ex-coal carloads were more likely impacted by the much slower volume growth in US western ports.

(Source: Company annual reports & Author)

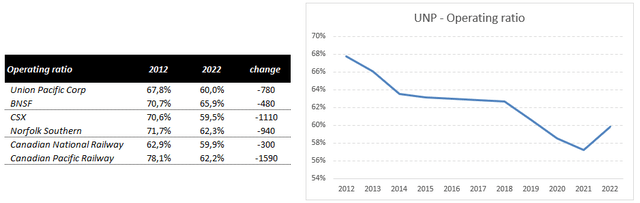

EBIT, net income and FCF growth was also much slower than peers but BNSF. In terms of efficiency, Union Pacific's operating ratio declined from almost 68% to 60% thanks to the implementation of Precision Scheduled Railroading (PSR) operating principles. Back in 1998, Canadian National Railway was the first to implement PSR, which explains its limited margin improvement. In 2012, Canadian Pacific was the second railroads to implement PSR in 2012, which again explains why its operating ratio improved so much. CSX started implementing PSR principles in March 2017 while Norfolk Southern and Union Pacific started to adopt them in the second half of 2018. Finally, BNSF decided to not follow the industry trend, considering that PSR will only bring regulatory scrutiny and client's dissatisfaction.

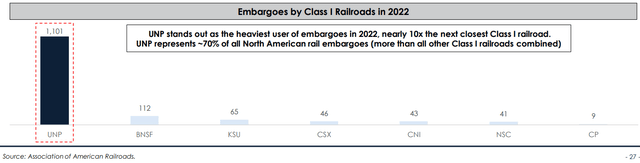

While we may argue that UNP deserve the lowest operating ratio because it has one of the best rail networks, its long-term 55% operating ratio target seems difficult to reach. The company has talked about it for a long-time without being able to reach it. However, its different attempts to reduce operating costs led to a deterioration in service quality and operational resiliency while increasing government scrutiny, employees' complaints (safety) and shippers' dissatisfaction (service disruptions). For instance, UNP has used more embargoes in 2022 than any other railroad to clear up rail traffic congestion across its network.

(Source: Soroban Capital Partners and Association of American Railroads)

A turnaround story with a new CEO

Following pressures from Soroban Capital, Union Pacific decided to replace the CEO Lance Fritz with Jim Vena. According to the hedge fund, UNP has been the worst performing Class 1 railroad under Lance Fritz's 8-year tenure in terms of safety, volume growth, revenue growth, cost management, EBIT growth and total shareholder return. Soroban Capital believes that replacing the CEO by Jim Vena will unlock value.

While we agree with many statements, we are not sure that the new CEO will be able to deal with all challenging tasks. Indeed, even though Union Pacific underperformed peers, volume declined for all the US industry. Growing volume would first require fixing service level issues, which would most likely impact company profitability because it will require hiring employees, increasing the number of trains in service…

(Source: Company annual reports & Author)

Valuation

Despite lacklustre volume growth, UNP offered Stellar total shareholder return over the past decade (+15.5% CAGR) and outperformed the S&P 500 (+13.7%). This return was driven by a combination of low double-digit EPS growth resulting from pricing, efficiency measures (operating margins increased from 32% to 40% between 2012 and 2022) and share buyback (share count decreased by -4% CAGR) while valuation multiples have significantly expanded (PE ratio increased from 11x to 19x over the last decade).

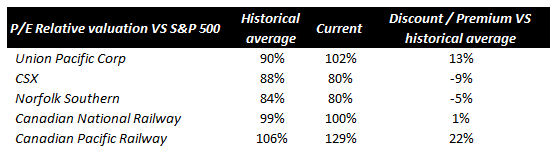

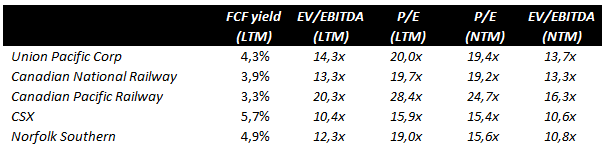

UNP is currently trading at a FCF yield of 4.1% and a P/E and EV/EBITDA of 19.4x and 13.7x, respectively. Both earnings-based valuation metrics are trading above their historical average (15.9x and 11.1x, respectively). Once adjusted for working capital inflow (it tends to be an outflow in general), FCF yield decrease to <4% while its historical average is at 4%. While compared to the P/E ratio of the broad S&P 500, UNP used to trade at a 10% historical discount whereas it is currently trading in line.

(Source: Bloomberg and author)

Finally, UNP does not look undervalued while compared to its peers. It trades at lower valuations than Canadian peers that enjoy a better volume dynamic and higher valuations than eastern peers that have a more complicated rail network.

(Source: Bloomberg and author)

Given current valuation levels and past valuation multiples expansion, valuation multiple changes should have a limited impact at best. However, while price increases will continue, we think that it should be at a lower pace given company's pricing is already above what the STB considers as non-competitive and service quality has significantly deteriorated. We also believe that a return to volume growth can be difficult because trucking kept gaining market share despite being more expensive and less environmental-friendly. Current service quality and recent issues surrounding the industry would not help. Efficiency measures should have a lower impact on company profitability given that it has already implemented PSR approach and there are more and more voices (including the regulators) questioning the impact of PSR on the deterioration of freight services and safety. Finally, share reduction should also have a lower impact on TSR. Indeed, UNP is not able to issue debt to buy back shares as it has done over the last decade. Over the last 10 years, UNP spent $ >111B ($ 73B for share repurchases and dividends and $ 38B in capex) while it generated only $ >87B in cash from operations. As a result, it had to plug the hole with $ 25B additional debt, which led to an increase in the net debt to EBITDA ratio from 0.9x to 2.7x. All in all, we believe that EPS may grow around mid-single digit CAGR over the coming years, which is lower than in the past. Even adding a 2% dividend yield, the expected return is below our 10% threshold.

The most bullish investors could argue that Union Pacific owns invaluable assets given the impossibility to replicate the networks. Others will point out that the cost of building railways is prohibitive. With a current enterprise value of $ 168.7B and 32.500 route miles, the current valuation per route miles is slightly more than $ 5 million, which is significantly less that the cost of recent projects ($ 107 million per kilometre or $ 172 million per mile) or the $3.5 million and $4.5 million for each route mile estimate (excluding land acquisition costs). We believe no one (including strategic buyers) will value the company at replacement costs. In fact, Canadian Pacific purchased KSU and its 7.100 miles of track for $ 30.2B, equivalent to $ 4.2 million per route mile (KSU owns the land).

In short, UNP has a wide moat business with one of the longest durability profiles. We do not consider valuation metrics as supportive and believe that revenue growth will be muted while company's profitability should remain under pressure. UNP has limited reinvestment growth opportunities (cannot build new tracks), which limits the growth in company's intrinsic value. As a result, we prefer to wait for a better entry point when valuations will be much more favourable.

"difficult" - Google News

September 09, 2023 at 06:00PM

https://ift.tt/taQVS8C

Union Pacific Stock: A Difficult Turnaround (NYSE:UNP) - Seeking Alpha

"difficult" - Google News

https://ift.tt/GQuIa7S

https://ift.tt/1zuDByY

Bagikan Berita Ini

0 Response to "Union Pacific Stock: A Difficult Turnaround (NYSE:UNP) - Seeking Alpha"

Post a Comment