California-based Collectors Universe (NASDAQ:CLCT) is one of the leading independent providers of authentication and grading services for collectors and dealers of collectibles. The less than $300 million company is probably lesser known in the stock market, but it is a household name in the community of high-value or high-priced coin and trading card collectibles.

The deliverable of Collectors Universe's service is the certification bearing one of the company's brands (i.e., "PCGS," "PSA," "PSA/DNA"), which may increase the value of the collectible and improve its marketability and liquidity in the market. As of fiscal 2019, approximately 57% of the company's sales come from coins authentication and grading service and 37% from trading cards and autographs. In the meantime, the domestic market contributed to almost 90% of the total revenue.

- Warning! GuruFocus has detected 5 Warning Signs with CLCT. Click here to check it out.

- CLCT 30-Year Financial Data

- The intrinsic value of CLCT

- Peter Lynch Chart of CLCT

In our opinion, Collectors Universe largely relies on its intangible assets to not only deliver the customer value but also grow and protect shareholder value. When it comes to an "endorsement" type of business model, reputation matters the most in terms of fending off competition and strengthening the barrier of entry. One example of this is Exponent (NASDAQ:EXPO), which we previously discussed in terms of failure analysis.

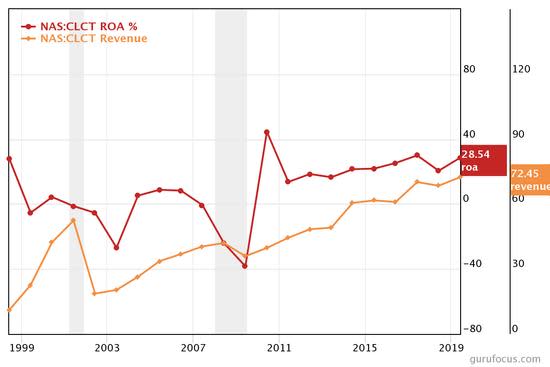

As for high-value, high-price collectibles, purchasers would generally not risk a significant monetary or non-monetary loss by having the items ungraded or graded by a lesser-known brand. It is estimated that PCGS has a share of over 50% in the coin authentication market and that PSA dominates the sports and trading cards grading space with a more than 75% market share. In light of such a monopoly-like position with a solid track recording of grading 41 million coins since 1986 and 35 million trading cards since 1991, we believe that the competitive threat facing Collectors Universe in its niche is quite limited. The moat of the business resonates with the consistently high returns on capital that we have seen over the last decade (see below).

Then our focus turns to the "offense" side, where, unfortunately, we do notice a bit more long-term uncertainty at the moment. The management emphasizes that all independent providers of authentication and grading services, in terms of both the vintage United States coins and the vintage trading cards, have penetrated less than 10% of their potential market. Nonetheless, we would consider the total community of collectors as a more contributing factor here. In this regard, the demographic trend may dampen the growth opportunity, at least in the U.S. coin segment. We have seen waning interest among young collectors, and at the same time, the aging collectors, which are the primary group of target consumers for Collectors Universe, are inevitably starting to cash out.

Indeed, the company has been making efforts to increase its geographical reach (e.g., France, Japan, China) as well in order to expand into adjacent verticals. However, both initiatives go beyond the company's core competency, in our view, and hence have yet to prove anything secular. Besides, a relatively minor risk is the cyclical nature of the business. As you can see above, both the top line and the return on assets went south during the past two recessions.

Disclosure: The mention of any security in this article does not constitute an investment recommendation. Investors should always conduct careful analysis themselves or consult with their investment advisors before acting in the stock market. We do not own any security mentioned in the article.

Read more here:

- Urbem's 'Wonderful Business' Series: Jack Henry & Associates

- A Pick and Shovel Strategy to Avoid Competition and Speculation

- Why We Like the Mid-Sized Category in the Fast-Moving Consumer Goods Space

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

- Warning! GuruFocus has detected 5 Warning Signs with CLCT. Click here to check it out.

- CLCT 30-Year Financial Data

- The intrinsic value of CLCT

- Peter Lynch Chart of CLCT

"easy" - Google News

February 07, 2020 at 12:38AM

https://ift.tt/37bIFuM

Collectors Universe: An Easy-to-Understand 'Intangible Assets' Business - Yahoo Finance

"easy" - Google News

https://ift.tt/38z63U6

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Collectors Universe: An Easy-to-Understand 'Intangible Assets' Business - Yahoo Finance"

Post a Comment