GoodLifeStudio

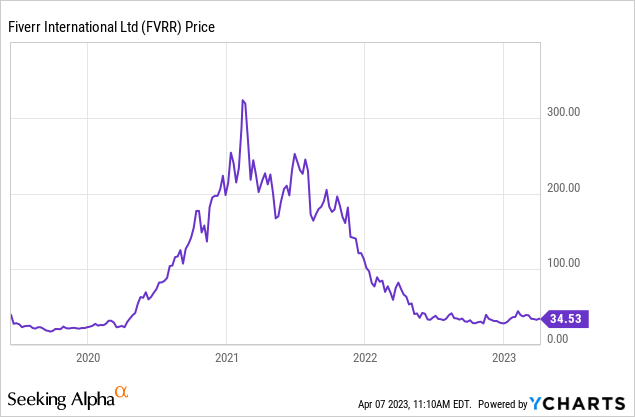

Although Fiverr (NYSE:FVRR) saw a nice pop after reporting better than expected profitability in Q4, the stock has pulled back in recent weeks as macro fears continue to weigh on the market.

FVRR saw significant benefits during the initial phase of the pandemic as companies and individuals quickly adopted freelance work in replacement of full-time jobs. At the time, this was a great replacement and the company saw revenue materially accelerate. However, as the world has returned to a more normal status and the macro environment has started to show cracks, FVRR's growth prospects have slowed down.

For 2023, the company is expecting just 4-8% revenue growth, though management did guide to a significant improvement in profitability as they focus on expense discipline. At face value, the profitability improvement is strong, but given the company added-back stock-based compensation equivalent to ~21% of revenue, the underlying profitability is not as strong as it appears.

After an initial pop post-earnings, the stock is now down ~25% since then. However, FVRR remains up ~20% so far this year. Given the challenging macro environment and the potential for things to get worse, FVRR may soon feel incremental pressure as investors shift to more recession-resilient companies.

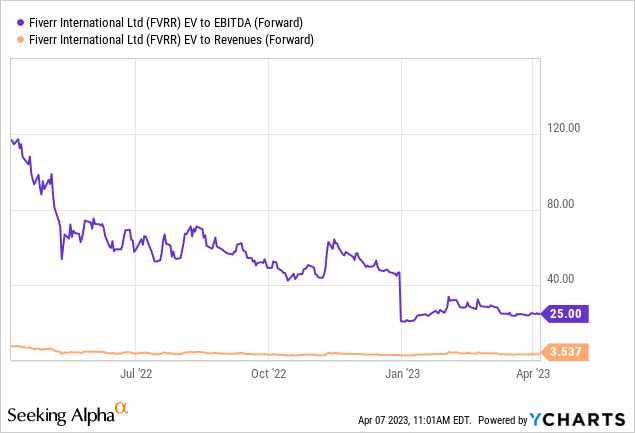

Valuation appears fairly valued at the maximum, if not a little overvalued. The stock currently trades ~3.5x forward revenue and ~25x forward EBITDA. Although considering revenue growth is decelerating and adjusted EBITDA includes a material amount of add-backs from stock-based compensation (which has only been increasing), investors should remain cautious.

For now, I remain on the sidelines and think the stock could continue to give up some of their year-to-date gains as investors look for more sustainable companies in the current macro.

Financial Review and Guidance

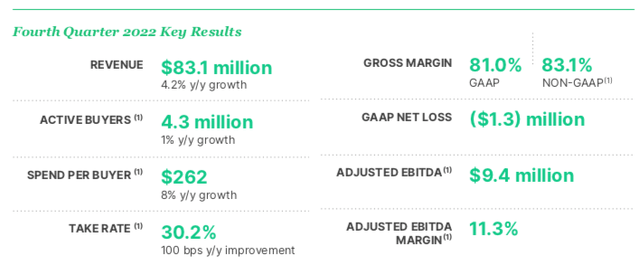

After several quarters of very strong growth driven by pandemic-related benefits, FVRR has started to come back down to reality. During the company's most recent quarter, they reported revenue growth of 4% yoy to $83.1 million, which was slightly below expectations for $83.5 million. Growth was driven by both active buyers and an increase in spend per buyer, as well as an increase in FVRR's take-rate, which grew to 30.2% during 2022 compared to 29.2% in 2021.

Fiverr

The number of active buyers during the quarter grew 1% yoy to 4.3 million, and the average spend per buyer increased 8% yoy to $262. While overall growth remains somewhat bleak, it's important to note that FVRR had historically played largely in the SMB space, which is increasingly being put under pressure from the current macro environment.

As FVRR focuses more on moving upmarket towards larger buyers, they could start to see more resilient growth, though this upmarket move won't be easy. Even though larger buyers typically have larger spending budgets, the current macro is causing companies of all sizes to place more controls around their spending habits. And given that employee expenses are the biggest line item for many companies, it's not shocking to see numerous layoff announcements in recent months, which may ultimately put pressure on a company's decision to use FVRR.

I believe over the next few quarters, FVRR may continue to see very little growth from the active buyer base and may need to rely more heavily on growing their average spend per buyer. The challenging macro may continue to pressure company budgets and with the March jobs report showing signs of a slowdown, this pressure may continue over the coming quarters.

Fiverr

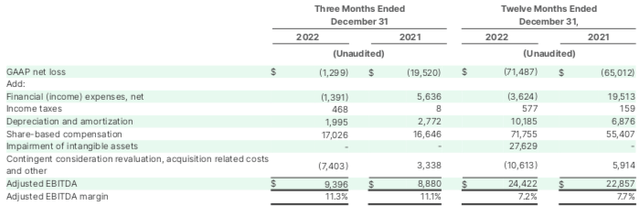

Also during the most recent quarter, FVRR's adjusted EBITDA of $9.4 million came in above consensus estimates for $7.7 million, which came to a surprise for many. While some of this outperformance was driven by better expense discipline, it's important to dive deeper into the moving pieces.

For 2022, the company reported adjusted EBITDA of $24.4 million, which was up from $22.9 million in 2021. While this does represent yoy margin contraction, there are more concerns under the hood that may remain an issue over the next several quarters.

GAAP net loss for 2022 was $71.5 million, which was lower than the $65 million loss in 2021. The biggest add-back continues to remain stock-based compensation, which reached an egregious $71.8 million in 2022 and represented 21% of total revenue. This compares to $55.4 million of stock-based compensation in 2021, representing 19% of revenue.

So despite the adjusted EBITDA dollar improvement in 2022, most of this was driven by increased stock-based compensation add-backs. Yes, I believe it's important, and in many cases essential, for tech companies to compensate their employees with stock options. This makes recruiting and retention easier for companies, however, too much stock compensation is not as great as it seems.

If a company's adjusted EBITDA dollars are growing yoy but it's largely attributed to the add-back of stock-based compensation, is profitability really improving? I would argue no and believe this is something that FVRR, as well as many other tech companies, may need to more directly address over the coming quarter and years.

In a macro environment where profitability metrics are becoming increasingly important, it's not a great signal to see adjusted EBITDA improvements being aided by larger stock-based compensation add-backs. The true underlying profitability of FVRR still has a long way to go.

Fiverr

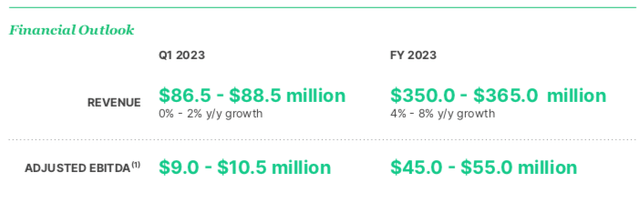

For Q1, the company is expecting revenue of $86.5-88.5 million, which was similar to consensus expectation of $87.3 million and reflects 0-2% yoy growth.

For the full-year 2023, the company expects revenue of $350-365 million, which was below consensus expectation of $366 million and reflects 4-8% yoy growth. Embedded within the company's guidance includes the expectations that revenue growth accelerates throughout the year.

More importantly, the company guided to adjusted EBITDA of $45-55 million and was well above consensus of $37.1 million. This guidance reflects ~14% margin at the midpoint, a notable improvement from the 7.2% adjusted EBITDA margin reported in 2022. Management discussed their discipline around expenses and ability to expand margins during the earnings call.

For 2023, we will build on the progress of 2022, to deliver further headway towards our long-term Adjusted EBITDA margin target of 25%. While the macro continues to be highly uncertain, with discipline and control, we are committed to accelerate the pace of our Adjusted EBITDA margin expansion this year.

With a shift in the macro environment and SMB spending sentiment, we quickly adjusted our business focus to drive efficiency, which is reflected in us delivering the most profitable quarter in the company’s history in terms of Adjusted EBITDA.

That said, our strategy and ambition to change the future of work remains unwavering. We have a strong roadmap for 2023 and we will execute with intensified focus and efficiency to become more profitable.

2023 profitability guidance was stronger than expected despite revenue growth coming in slightly below. The biggest question investors should have now is if management is able to deliver on their profitability commitment.

Another concern with guidance is management's expectation for revenue growth to accelerate throughout the year. While it's certainly possible for the macro to improve or underlying drivers of FVRR to turn positive, embedding this within guidance may be a little too optimistic. It's possible that during FVRR's next earnings call, management may become a little more constructive of their guidance.

Valuation

FVRR has been a challenging name when it comes to valuation. During the pandemic, many investors quickly saw the benefit of freelance workers and the stock ripped higher. However, as the macro environment normalized and has now started to show some cracks, the company's revenue growth has been put under pressure.

During the good times, many investors would use a revenue multiple for valuation given the significant growth rates and perceived massive long-term opportunity. Now that growth has materially moderated, I believe it becomes more prudent to use adjusted EBITDA as a better valuation tool.

FVRR stock currently trades ~3.5x forward revenue and ~25x forward adjusted EBITDA. Given management's 2023 guidance of 4-8% yoy revenue growth and adjusted EBITDA margin expanding to ~14% (from 7.2% in 2022), there is quite a bit of growth embedded within guidance.

On one hand, we have seen many pandemic-fueled growth companies have the ability to trim their expenses, as many over-invested for growth during the 2020-2021 boom. Now that the macro environment has slowed down, investors are being more prudent on profitability, which could shift focus more towards profitability valuation metrics.

Given the stock's current valuation as noted above, I believe the stock remains fully priced for a strong 2023 performance. In addition, while 25x forward EBITDA is not an overly aggressive figure, this does include FVRR's significant stock-based compensation. Excluding this add-back, or at least normalizing it for a more reasonable figure, FVRR's forward EBITDA multiple would be much higher.

For now, I remain on the sidelines and believe the stock could trickle below $30 as investors become more realistic with the company's prospects and valuation.

One of the biggest risks for FVRR includes the slowing macro environment and tight labor market. If macro conditions continue to deteriorate, it's reasonable to believe that FVRR's growth could decelerate even further. In addition, the rise of ChatGPT and other generative AI models could cause the demand for certain freelance workers to slow. One example is with advertisements and journaling. Instead of hiring multiple people to design marketing campaigns and create advertisements, companies could eventually move towards generative AI models.

"difficult" - Google News

April 09, 2023 at 11:21AM

https://ift.tt/CLT0WuK

Fiverr Stock: Difficult Set Up Into Next Quarter; Shares Could Be Weak (NYSE:FVRR) - Seeking Alpha

"difficult" - Google News

https://ift.tt/s7LadWn

https://ift.tt/BMPEtcy

Bagikan Berita Ini

0 Response to "Fiverr Stock: Difficult Set Up Into Next Quarter; Shares Could Be Weak (NYSE:FVRR) - Seeking Alpha"

Post a Comment