The past few weeks have been stark reminders that the stock market actually is volatile. After a decent start to the year that saw the S&P 500 up a solid 5% including dividends less than six weeks into 2020, investors have experienced the fastest 10% drop in market history. The market index lost 13% at one point, and even after two days when it surged upwards by close to 5%, it's still down for the year as of this writing. What a painful difference only two weeks has made.

Many stocks are down much more, and lots of investors are selling out, simply because it's hard to watch your stocks move so wildly. If you're having trouble sitting by and watching your portfolio make these big swings from one day to the next, it may be time to add some low-beta stocks to your portfolio. In short, low-beta stocks have a history of being less volatile than the market, helping smooth out what happens during uncertain times.

Image source: Getty Images.

Three to consider are Brookfield Infrastructure Partners (NYSE: BIP), CareTrust REIT Inc (NASDAQ: CTRE), and McDonald's Corp (NYSE: MCD). Not only have they proven less volatile in a market that's increasingly uncertain, but they also pay investors reliable dividends that can be counted on across even the most insecure of markets. That's a surefire combination that can make them ideal holdings if volatility has you on the verge of selling out and sitting on the sidelines.

Beta explained, and how low-beta stocks can help your portfolio

Beta is a measure of volatility, with a beta of 1 being exactly as volatile as the benchmark (usually the S&P 500). When a stock's beta is below 1, it means the stock is less volatile than the market while a beta above 1 means a stock is more volatile. The three stocks above have proven historically to be less volatile than the market:

BIP Beta (1Y) data by YCharts.

Below is a chart that helps show how this plays out when the market gets really volatile. Since February 19, the S&P 500 fell more than 12% at one point before a series of wild swings up, back down, and up again. That includes both the fastest double-digit drop in market history and two market days that saw stocks gain almost 5%:

That's a lot of volatility in a very short period of time, which can be really hard to ride out. But when you also own lower-beta stocks like the three above, you can see how you can benefit during times of market turmoil. As the chart above shows, all three stocks lost value during the recent sell-off but none fell anywhere near as much as the broader market. They've also started to recover their more modest losses more quickly.

In summary, low-beta stocks tend to hold more of their value when uncertainty is causing the stock market to swing wildly. And if you have a history of selling your stocks just because they're volatile, a low-beta mix in your holdings could help you avoid selling just because stocks are falling.

McDonald's as a case study on the value of low-beta stocks

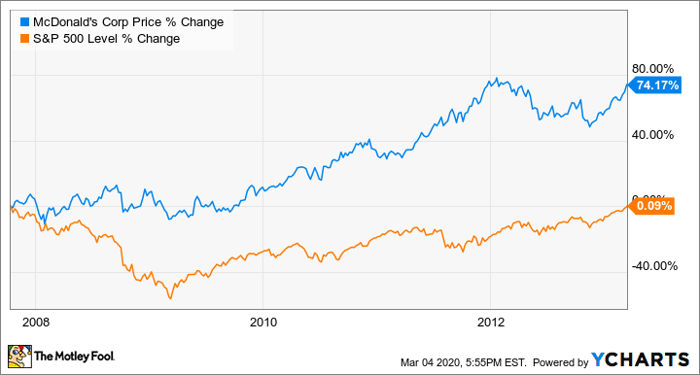

We can use McDonald's to show how low-beta stocks can be really helpful investments to own during worrisome market conditions. Let's take a look at how its stock performed during the global financial crisis, one of the worst periods for stocks in the past century:

From the October 2007 peak to the March 2009 bottom, global stock markets lost more than half their value, and there were very real fears that it would take many, many years to recover that lost value and for the global economy to recover.

Yet even at the very bottom, McDonald's stock held up relatively well, only losing about 10% of its value at its low point, and was down barely more than 8% when the S&P 500 hit bottom. And while it would take some time for stocks to recover -- it wasn't until March of 2013 that the S&P 500 returned to the 2007 peak -- McDonald's proved to be a wonderful investment:

Why did McDonald's hold up so well? Because of the value it represents to consumers and the quality of its operations. Sure, many restaurants struggled during the Great Recession, but they were mainly casual sit-down eateries, as people tightened their belts. Even McDonald's saw revenue declines during the worst of times but business stabilized quickly. While casual chains struggled, business actually improved for McDonald's:

MCD Revenue (TTM) data by YCharts.

And while coronavirus is likely to once again hurt business for many sit-down restaurants, McDonald's drive-thrus and partnerships with food-delivery services will keep it busy and relevant in the current environment, just as its low prices did during the last recession.

Recurring revenues and recession-resistance for Brookfield and CareTrust

While these two companies don't sell fast food, they have businesses that are built for stability. Respectively, they own infrastructure assets like water and telecommunications systems for the former and senior housing and skilled-nursing properties for the latter.

In both cases, that means they don't rely on consumer spending to prop up their results. For Brookfield, people and businesses rely on water, energy, and telecom services regardless of economic conditions. CareTrust's skilled nursing and seniors housing properties are in demand as people age and need special care. This is a demographics-driven trend, and not something that's tied to the state of the economy.

Their business models, as a result of the steady, recurring cash flows they generate, are conducive to paying high dividend yields. At recent prices, both yield almost 4% and have track records of raising their payouts near or above 10% on an annual basis.

Make it easier to sit on your hands in uncertain times

Adding low-beta stocks like McDonald's, Brookfield Infrastructure, and CareTrust to your portfolio can make it much easier to hold when the market gets uncertain. That's doubly true when you add in the dividends they pay, especially considering that the value of that dividend has gone up sharply over time:

BIP Dividend data by YCharts.

If you're worried about being able to ignore your portfolio if we keep seeing so much volatility, it may be time to add some high-quality, low-beta stocks like these to your mix.

10 stocks we like better than Brookfield Infrastructure Partners

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Brookfield Infrastructure Partners wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of December 1, 2019

Jason Hall owns shares of Brookfield Infrastructure Partners and CareTrust REIT. The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

"easy" - Google News

March 07, 2020 at 06:14PM

https://ift.tt/2TYK3fJ

Is Market Volatility Making You Sell? 3 Dividend Stocks That Are Easy to Hold - Nasdaq

"easy" - Google News

https://ift.tt/38z63U6

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Is Market Volatility Making You Sell? 3 Dividend Stocks That Are Easy to Hold - Nasdaq"

Post a Comment